BUSINESS-FRIENDLY NEVADA with PRO-BUSINESS TAX CLIMATE

Nevada’s Tax Structure:

-

NO Corporate Income Tax

-

NO Personal Income Tax

-

NO Inventory Tax

-

NO Unitary Tax

-

NO Estate and/or Gift Taxes

-

NO Franchise Tax

-

NO Inheritance Tax

-

NO Special Intangible Tax

Low Cost of Doing Business

-

6% lower than the national average

(Forbes, November 2018)

-

One of the lowest costs to incorporate in the United States

Right-to-Work State: Right to Work Laws secure the right of employees to decide for themselves whether or not to join or financially support a union

State Business Incentives: a variety of incentives to help qualifying companies

Low Workers Compensation Rates: Ranked #46 out of 51, Nevada has a payroll cap of $36,000 of reportable payroll per employee, per employer, per year

Strong Focus on Renewable Energy: geothermal, solar and wind

Northern Nevada

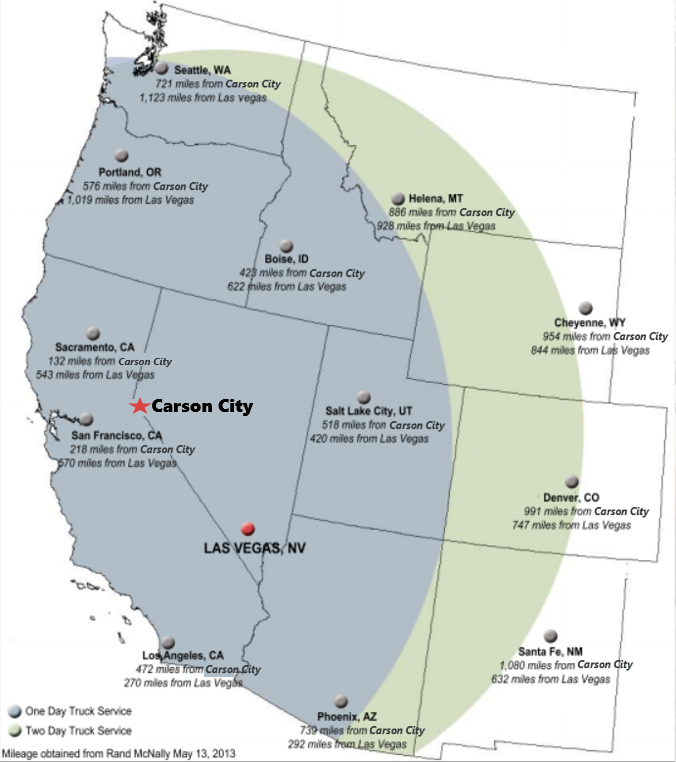

Logistics Hub

-

Reach nearly 60,000,000 customers within a one-day truck transit

-

Close proximity to the Western U.S. and U.S. deep water seaports serving the Pacific Rim

-

Easy access to the state’s multi-modal transportation infrastructure

-

More than 50 freight carriers and 65 trucking companies offer transcontinental fast-freight and van-line shipping

-

Reno-Tahoe International Airport is one of the nation’s most reliable air cargo centers

-

Reno has the largest concentration of distribution-related property per capita in the U.S.

Affordable Lease Rates

Competitive Utility Rates

Highway Access

-

I-80 – East-West

-

I-580 – Reno, Carson City, Carson Valley, and Lake Tahoe

-

US 50 – East-West

-

US 95 – Connects I-80, US 50, and I-15

-

US 395 – North-South

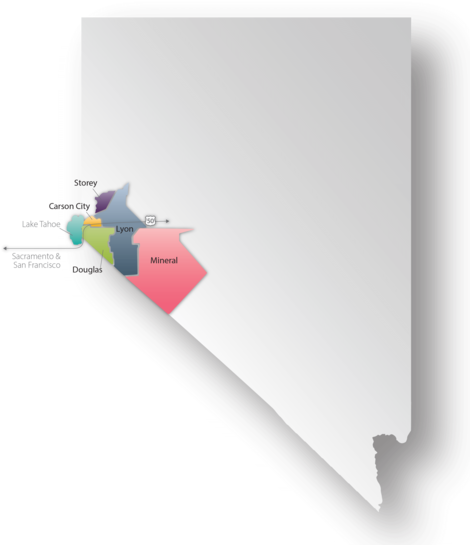

Sierra Region of Nevada

-

3rd largest metropolitan area in the Silver State

-

Located in Northern Nevada and includes Carson City (State Capital) and Lake Tahoe’s south shore

-

Easy access to elected and government officials

-

Served by Western Nevada College (Carson City), home to the only International Mechatronics Certificate Program in the Western U.S.

NEW/RELOCATING BUSINESSES

Favorable Tax Structure and Pro-Business Regulatory Environment

RIGHT-TO-WORK STATE

The cost of doing business is less than the national average, and there are no corporate & personal income taxes.

WORKFORCE INCENTIVES

Financial Reimbursements & Training Allowances for Eligible Employers

PRE-SCREENED QUALIFIED WORKERS

Receive up to $2,000 per employee in incentive reimbursements or training allowances for new hires.

GROWING RESIDENT BUSINESSES

Assistance with Expansion and Growth

PROBLEM-SOLVING & SOLUTIONS

Work with an economic development team to connect with resources which facilitate growth and expansion.

SITE SELECTION

Finding the Right Location to Meet Business Objectives

COMMERCIAL & INDUSTRIAL SPACE

Work with a team of real estate professionals to identify properties which meet your company’s needs.

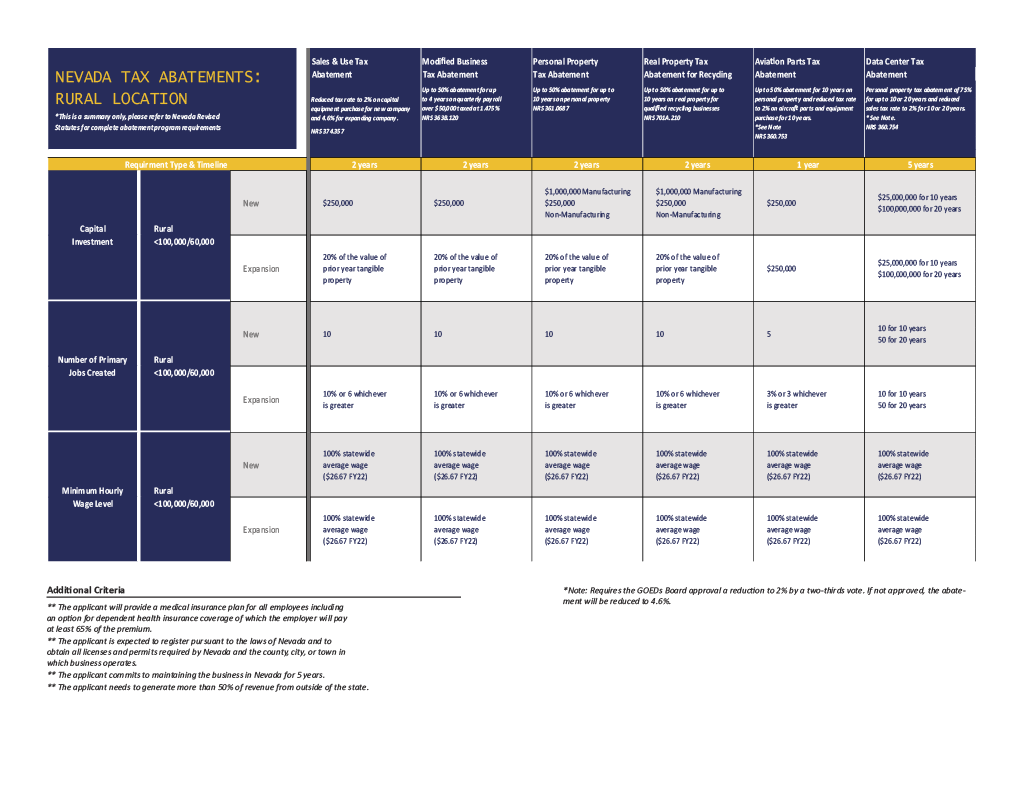

NEVADA BUSINESS INCENTIVES

A Variety of Abatements to Help Qualifying Companies

STATE TAX ABATEMENTS

Incentives are available for qualifying new, existing & relocating businesses to support their growth and success.

Turnkey Industrial Properties Reduce Risk

NEVADA BUSINESS INCENTIVES

A variety of incentives are available for qualifying new, existing and relocating businesses to support company growth and success.

Nevada Business Incentives Quick Guide

To qualify for incentives, a company must meet two of the three requirements (Capex, Jobs, Wage) and meet minimum health insurance standards.

-

The applicant will provide a medical health insurance plan for all employees including an option for dependent health insurance coverage of which the employer will pay at least 50% of the premium

-

The applicant is expected to register pursuant to the laws of Nevada and to obtain all licenses and permits required by Nevada and the county, city, or town in which business operates

-

The applicant commits to maintaining business in Nevada for 5 years.

NEVADA WORKFORCE INCENTIVES:

Silver State Works

Financial Incentives for Eligible Nevada Employers Who Hire Pre-Screened Qualified Workers

-

On the Job Training: Administered by Nevada Department of Employment Training and Rehabilitation (DETR)

-

Job Placement: Nevada JobConnect recruitment and employee search/job placement services are available at no cost to the employer

-

Employer Incentive Job Program: Receive 50% of participants wages through training period

-

Incentive Based Employment: Receive wage retention supplements of up to $2,000 per employee