Opportunity Zones Program Overview

New community development program created under the Tax Cuts and Jobs Act passed by the U.S. Congress on December 22, 2017

Added to the tax code and designed to be an Economic Development Tool to encourage long-term investments in low-income urban, rural and tribal communities nationwide

Opportunity Zones are:

-

Low income census tracts that meet federal criteria

-

Nominated by the chief executives of every U.S. state and territory

-

Certified by the U.S. Department of the Treasury

-

Tax incentives for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones

-

Pathways for investors to finance new projects and enterprises in exchange for certain federal capital gains tax advantages

Over 8,700 Opportunity Zones nationwide approved in 2018

For more information:

Opportunity Zones Nomination Process

Nominations by each state/territory limited to no more than 25% of eligible tracts

Nevada had 243 eligible tracts and nominated the maximum of 61 tracts

Governor’s Office of Economic Development (GOED) facilitated the nomination process

-

Sought public comment

-

Solicited input from the Regional Development Authorities (RDAs)

-

GOED’s final recommendations to Governor Sandoval were based on the number of potential projects and investment for each eligible census tract

-

NNDA suggested 11 Sierra Region census tracts – the Governor included 4 of them in his nominations

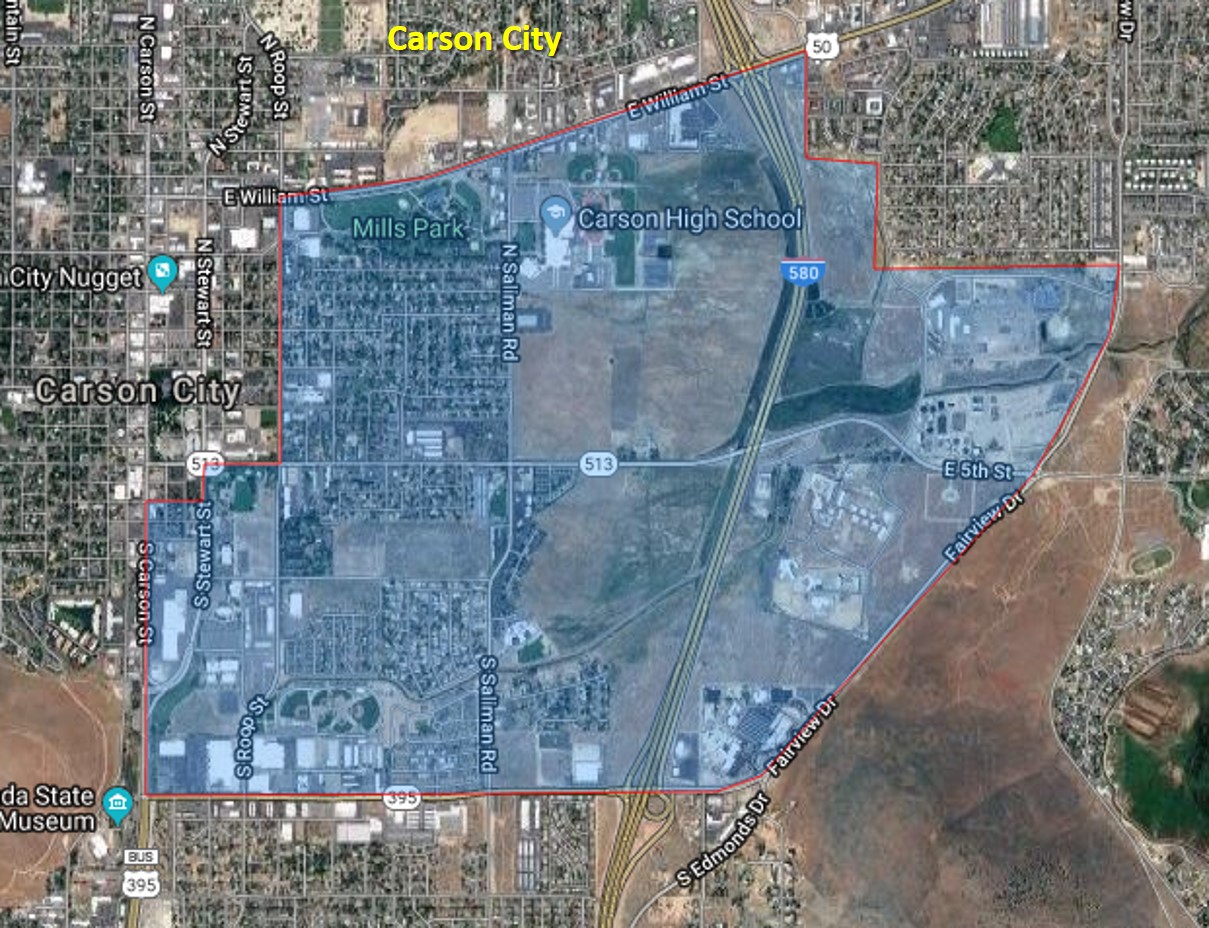

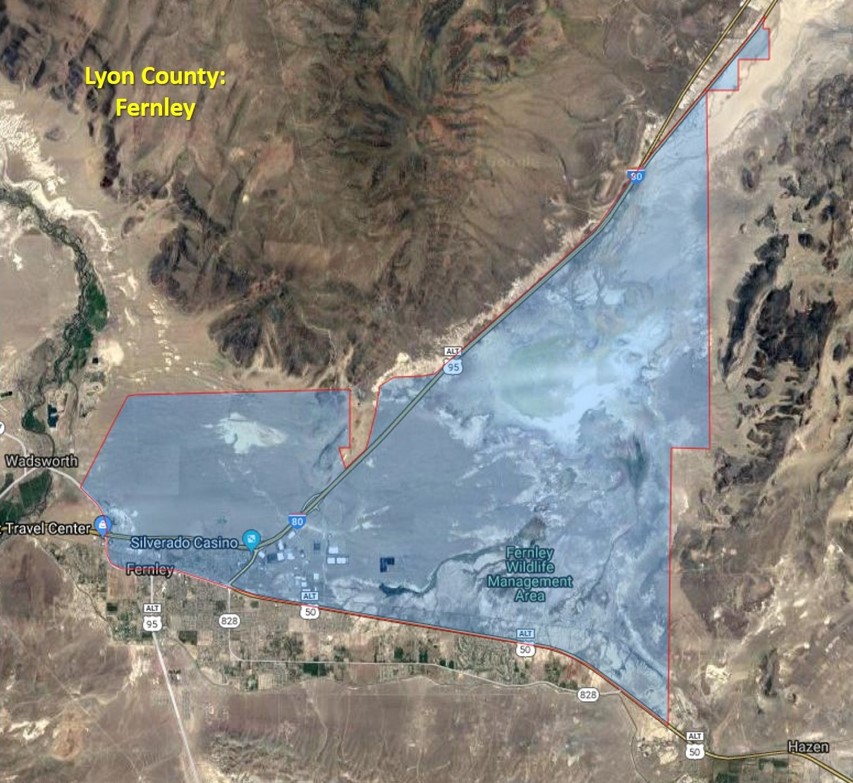

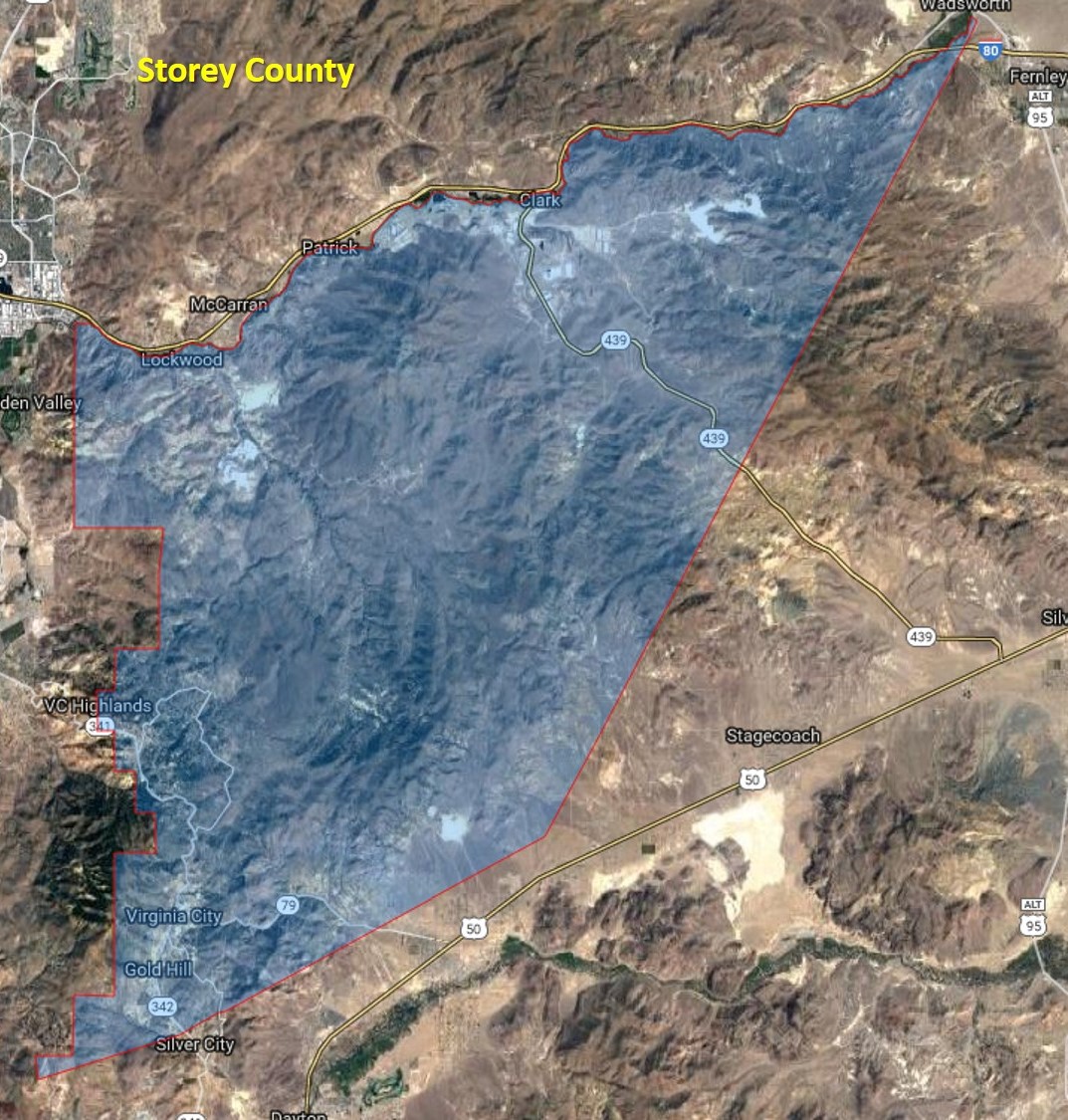

All 61 nominated census tracts were certified as Opportunity Zones by U.S. Treasury, including:

-

NNDA’s four nominations for the Sierra Region

-

One for the Pyramid Lake Paiute Tribal community

(Nevada was one of 26 states who included tribal areas in their nominations)