BUSINESS-FRIENDLY NEVADA with PRO-BUSINESS TAX CLIMATE

Nevada’s Tax Structure:

-

NO Corporate Income Tax

-

NO Personal Income Tax

-

NO Inventory Tax

-

NO Unitary Tax

-

NO Estate and/or Gift Taxes

-

NO Franchise Tax

-

NO Inheritance Tax

-

NO Special Intangible Tax

Low Cost of Doing Business

-

6% lower than the national average

(Forbes, November 2018)

-

One of the lowest costs to incorporate in the United States

Right-to-Work State: Right to Work Laws secure the right of employees to decide for themselves whether or not to join or financially support a union

State Business Incentives: a variety of incentives to help qualifying companies

Low Workers Compensation Rates: Ranked #46 out of 51, Nevada has a payroll cap of $36,000 of reportable payroll per employee, per employer, per year

Strong Focus on Renewable Energy: geothermal, solar and wind

Northern Nevada

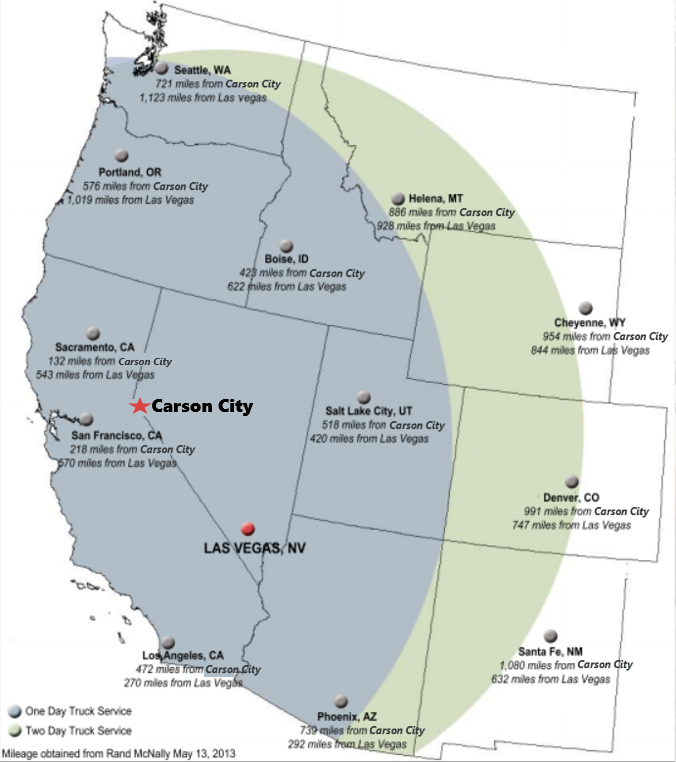

Logistics Hub

-

Reach nearly 60,000,000 customers within a one-day truck transit

-

Close proximity to the Western U.S. and U.S. deep water seaports serving the Pacific Rim

-

Easy access to the state’s multi-modal transportation infrastructure

-

More than 50 freight carriers and 65 trucking companies offer transcontinental fast-freight and van-line shipping

-

Reno-Tahoe International Airport is one of the nation’s most reliable air cargo centers

-

Reno has the largest concentration of distribution-related property per capita in the U.S.

Affordable Lease Rates

Competitive Utility Rates

Highway Access

-

I-80 – East-West

-

I-580 – Reno, Carson City, Carson Valley, and Lake Tahoe

-

US 50 – East-West

-

US 95 – Connects I-80, US 50, and I-15

-

US 395 – North-South

NEW/RELOCATING BUSINESSES

Favorable Tax Structure and Pro-Business Regulatory Environment

RIGHT-TO-WORK STATE

The cost of doing business is less than the national average, and there are no corporate & personal income taxes.

WORKFORCE INCENTIVES

Financial Reimbursements & Training Allowances for Eligible Employers

PRE-SCREENED QUALIFIED WORKERS

Receive up to $2,000 per employee in incentive reimbursements or training allowances for new hires.

GROWING RESIDENT BUSINESSES

Assistance with Expansion and Growth

PROBLEM-SOLVING & SOLUTIONS

Work with an economic development team to connect with resources which facilitate growth and expansion.

SITE SELECTION

Finding the Right Location to Meet Business Objectives

COMMERCIAL & INDUSTRIAL SPACE

Work with a team of real estate professionals to identify properties which meet your company’s needs.

NEVADA BUSINESS INCENTIVES

A Variety of Abatements to Help Qualifying Companies

STATE TAX ABATEMENTS

Incentives are available for qualifying new, existing & relocating businesses to support their growth and success.

Turnkey Industrial Properties Reduce Risk

NEVADA WORKFORCE INCENTIVES:

Silver State Works

Financial Incentives for Eligible Nevada Employers Who Hire Pre-Screened Qualified Workers

-

On the Job Training: Administered by Nevada Department of Employment Training and Rehabilitation (DETR)

-

Job Placement: Nevada JobConnect recruitment and employee search/job placement services are available at no cost to the employer

-

Employer Incentive Job Program: Receive 50% of participants wages through training period

-

Incentive Based Employment: Receive wage retention supplements of up to $2,000 per employee